Milton Freedman once wrote “the political system is not inclined to bring about policies that would reduce the scope of government. Politicians win elections by promising benefits, not by imposing burdens.” What Freedman was suggesting was a simple truth, namely that the democratic tendency is always for the state to keep growing by venturing into ever expanding domains where it previously had no business. State power, and responsibility, creeps through promises and manifestos that politicians produce to woo the voters into areas that once were the strict domain of the individual, or family, or civic organisation. Take education, or the fire service, or for that matter the police, these were all in the private domain, before politicians, rightly by any account, decided to take them into the public realm as it was perceived to be a universal public good.

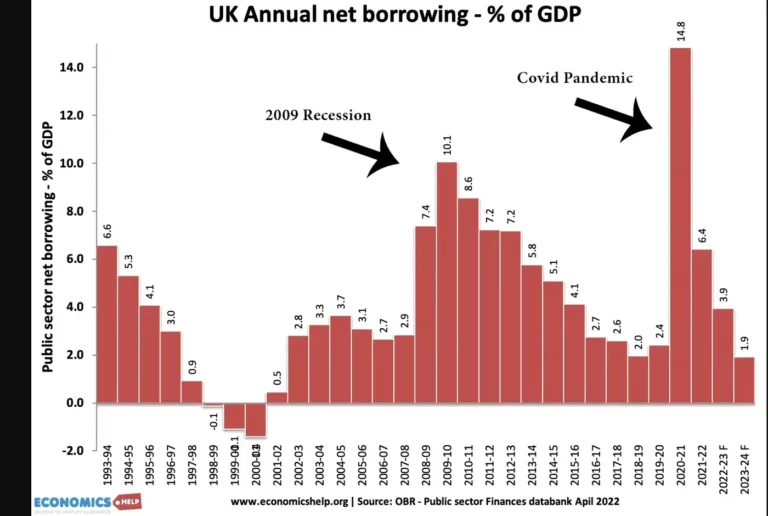

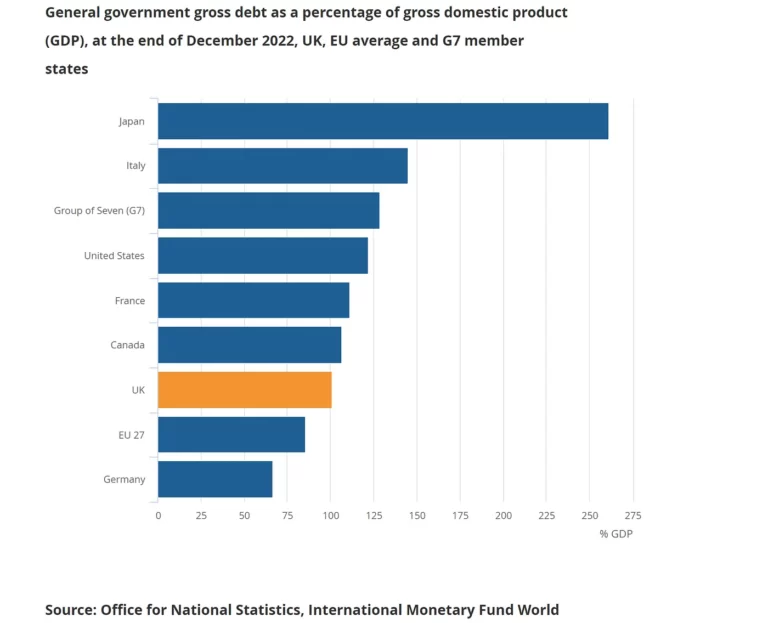

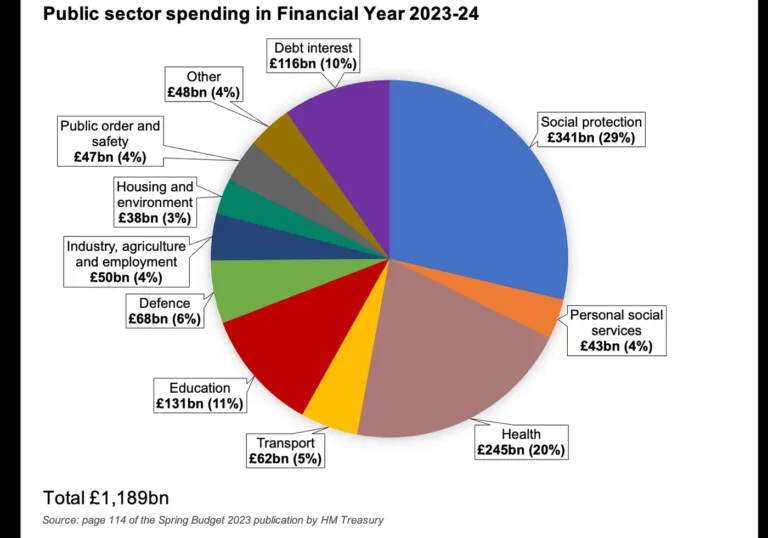

“Politicians”, said James Buchanan, “like everyone else, respond to incentives. When they can get away with overspending, overpromising, and overcommitting, they will.” His words echo true today more than ever. Prime ministers of every colour and philosophical inclination from Blair to Brown, even Cameron to Johnson, and now Sunak have all expanded the remit of the state. Each has spent and borrowed continuously increasing the overall debt of the country. Ten percent of all the tax collected by the exchequer will be spent on servicing the UK national debt.[1] In most developed economies the numbers tell the same story, because politicians have worked out that so long as every country proportionately continues to overspend and over commit, the markets will be hoodwinked into a false sense of reality, at least in the short term, exactly what politicians prefer to think about — the short term. Ultimately, however, reality catches up in the form of inflation. Inflation, if not tackled quickly, has the power to bring down nations and even empires. History is a graveyard full of such nations and empires that ruled for centuries only to be brought to its knees by inflation caused by reckless fiscal management.

Most developed economies today suffer from higher inflation, rising national debts, cuts in public spending, and burgeoning population of elderly citizens. Many in the West have lost confidence in the system, having spent the last two decades without a real wage rise, while the cost of living has spiralled. Only very recently have we seen any real rise in wages, and that too mostly from the private sector. This has quite rightly left many working-class, and younger voters disenchanted and out of love with open markets. Open markets have worked tremendously well to an extent, but not for everyone. Many people feel left behind. Citizens throughout the developed West are asking if we have run out of steam? Are we in need of a new economic model?

At the heart of this disenchantment is China. China brought to the world stage State Capitalism at a scale never seen before. Central to the idea is that protectionism is the way to cope with the buffeting of open markets. China’s extraordinary success convinced unions in the West that they had a lot to lose from the free movement of goods across borders. Then came Covid-19, which informed western policy makers that supply chains were fragile and needed near-shoring or onshoring again. China’s state capitalism, with its disregard for international law, human rights, and rule-based trading system, was seized on in developed countries as a justification for state intervention. Politicians laboured over the fragility of international supply chains, echoed by unions and the anti-globalisation lobby all culminating in building what some have called a ‘cathedral of fear’. That fear had to be addressed by more government, more intervention, more protectionism, and with ever more government comes ever more spending. We have begun to adopt, at our own peril, a Chinese inspired State Capitalism.

State intervention and closing of open markets is dangerous on several grounds. Open markets during downturns, if left alone, clear out poor businesses, those that are inefficient, or simply unable to modernise as per customer demands. This pain spurs innovation and new businesses are formed, and the economy is revitalised, creating new wealth and prosperity. None of which requires the government. We need only allow market forces to do their job. State protectionism reduces, or even protects us from this necessary pain. Governments to tackle inflation need to spend less, a lot less, and increase taxes to burn access liquidity in the market. The Conservative Party, under Sunak, has gone against its own ideological position of lowering taxes and has raised taxes to the highest level in modern British history as a percentage of GDP. Starmer, to his credit has indicated that he will maintain the Conservative status quo and keep Britain on a strict fiscal diet to bring down inflation. These are tough asks in a democracy. What Britain needs is less government, not more.

State intervention is often too slow, cumbersome, and incapable of meeting the demands of a modern globalised economy. The AI and energy transitions required are simply too fast paced and complex for government to plan. Ideas need to be tested and left to die, or rise, by markets, not government committees giving out subsides. Excessive regulation will inhibit innovation and, by raising costs, make change slower and ultimately more painful without clearing out all the deadwood in the economy. The problem is that politicians love spending other people’s money, and as government budgets get ever bigger, special interests will have a feeding frenzy and a growing influence.

The way forward: 7-points to keep in mind

The way forward is to simply have the courage to do what we know to be right. We know the way; our leaders just need to have the courage to walk it.

First, allow markets to do what they do best — meet consumer demand in the most efficient manner. In almost every sector government need not be active, and simply enable free market economics to take shape. Where supply outstrips demand, allow businesses to fail, ventures to go bust, and prices to fall.

Second, a stable monetary policy. In other words, control the liquidity in the economy with predictability. The central bank ought to independently of government control the money supply and increase it transparently and with predictability. Bail outs should be rare, within reason, nothing should be too big to fail, and certainly keeping the overall deficit down ought to be a priority.

Third, rule of law that is steady, predictable, and enforceable. Here government does have a role to play — regulation and law should enable safer transactions and a build-up of trust and transparency in the system — nothing more. It need not be coerced by vested interest groups and fear of negative press to make doing business more difficult and expensive. It should, however, enact the mandate given to it by voters to regulate healthcare, weapons manufacture, sex work, or anything that could diminish human flourishing over the medium term.

Fourth, enable open markets. Build infrastructure which empowers people to participate in the economy. Ease credit, make bankruptcy easier, and facilitate trade cross border. Education ought to be an area the government should invest in heavily and ensure that people who are churned out of the system are skilled, and characterful to navigate the open society. Another area of public spending should be healthcare and rail and road infrastructure — these are huge enablers for wealth creation and innovation.

Fifth, welfare reform. The state ought to provide a safety net for the most vulnerable in society, but it should rein in the tendency to give handouts as universal goods to every citizen. The welfare programmes should be enabling and empowering, as well as targeted and timebound.

Sixth, sound long term fiscal policy. In other words, when times are difficult, stimulate the economy with targeted spending and manage a steady deficit. Invest in smart large infrastructure projects. While when the sun is shining, be sure to make hay and build up a surplus rather than handing out tax cuts immediately.

Seventh, and final point, allow citizens the freedom and responsibility to make their own lives. A truly open society enables innovation and therefore risk. People ought to be encouraged to pursue wealth creation, but also allowed to fail without the stigma or legal incrimination when things do go genuinely wrong. In a free society where markets flourish people must be able and capable to bear the consequences of their decisions.